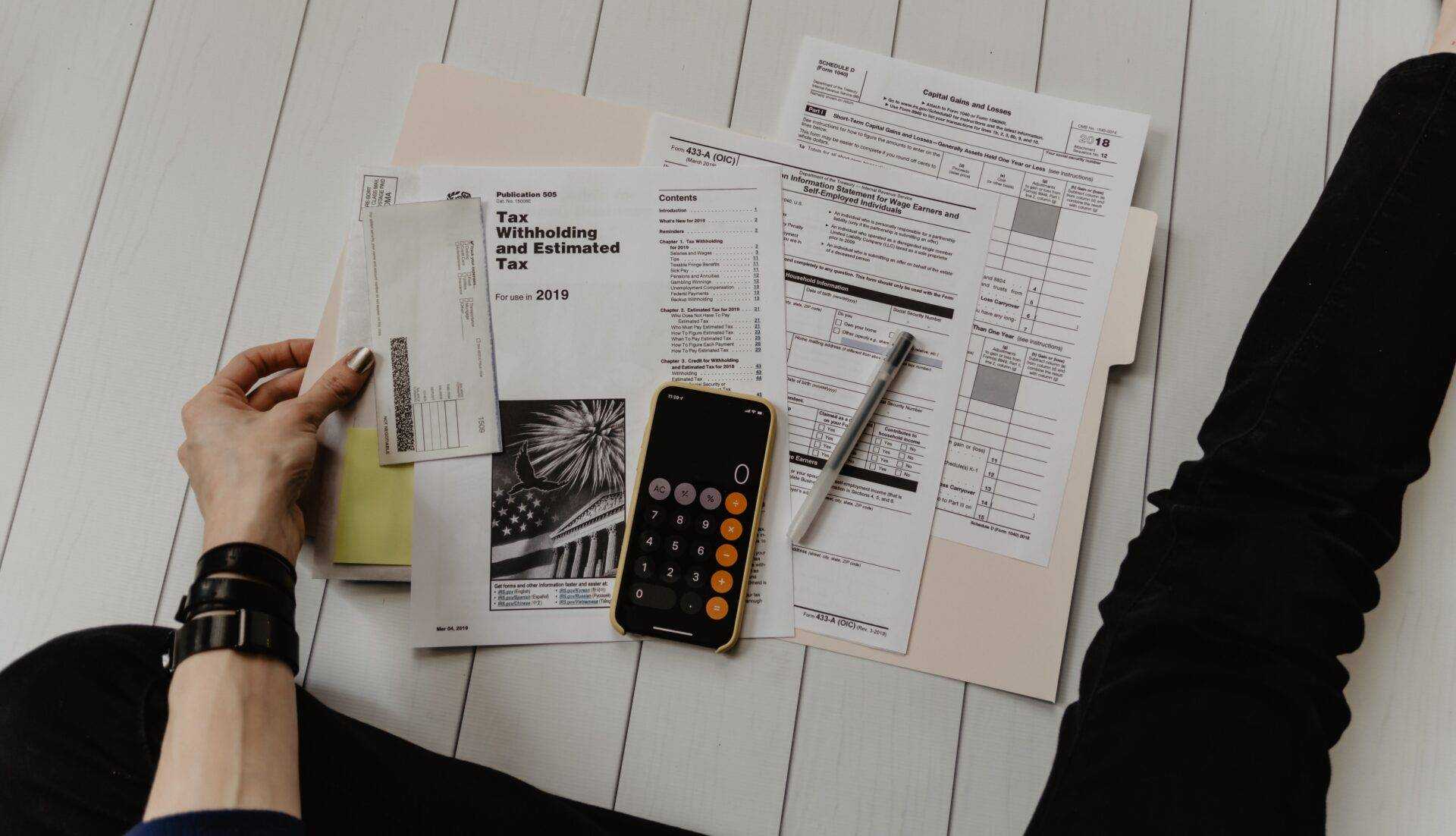

Outsourcing Your Bookkeeping: The 7 Advantages of Doing So

As a business owner, you’re well aware that staying on top of your finances is crucial for your company’s success. However, managing your bookkeeping can be a tedious and time-consuming task, especially if you’re wearing multiple hats within your business. That’s where outsourcing your bookkeeping needs comes into play. By enlisting the help of a […]

Outsourcing Your Bookkeeping: The 7 Advantages of Doing So Read More »