Proactive business accounting & tax solutions.

We help Perth and Australia-wide businesses and investors save tax and improve profits and cash flow. We offer a monthly subscription-based service so you know what you are paying for with added benefits.

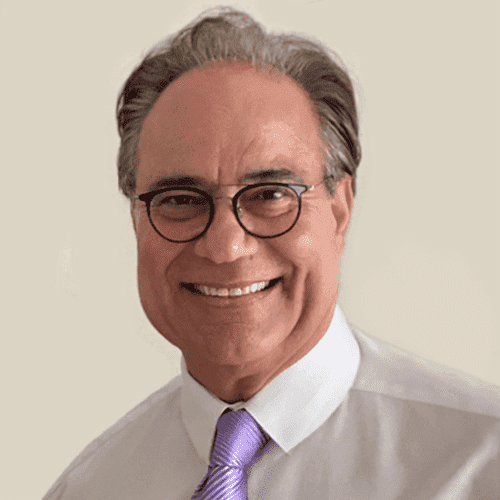

Vince Ilarda I Founder & CEO.

“My team and I are dedicated to helping our clients achieve their personal and business financial goals and pay less tax.”

How we help business owners.

We work with clients who want to better understand the numbers that grow their business. We assist you in your journey, whether you’re a startup or an established and growing business.

Start or buy a business.

We will help with expert advice on accounting, tax, business structures and funding for business start-ups or purchases.

“The team at Prosperity Accountants gave me great advice on how to structure my new medical clinic. I cannot recommend them enough.”

Dr J. Withnall

Manage your accounting and tax compliance.

All businesses have to manage their accounting and tax compliance, but we do it with a commercial edge and for a fixed price.

“Prosperity Accountants have been a lifesaver for my small business, providing expert accounting and tax guidance that has helped me to streamline my finances and operate with confidence.”

M. Morgado

Minimise your tax.

Our experienced professionals provide tax minimisation strategies to help you keep more of your hard-earned money.

“Prosperity Accountants have been a game-changer for my business, their in-depth knowledge of tax law and strategies has helped me legally minimize my tax position.”

M. Sanders

Improve your profits and cashflow.

Our team will show you ways to grow your business, profitably and increase cash flow, using our proven business advisory services.

“Prosperity Accountants provided me with advice when I was thinking of expanding my manufacturing. They helped me complete a business plan and submit to my bank who funded the expansion”

M. Cosby

Protect your assets.

You’ve worked hard building your assets, but are they adequately protected? We will show you how.

“Prosperity Accountants have been a trusted advisor in helping me protect my assets and secure my financial future through their innovative asset protection strategies.”

N. Coote

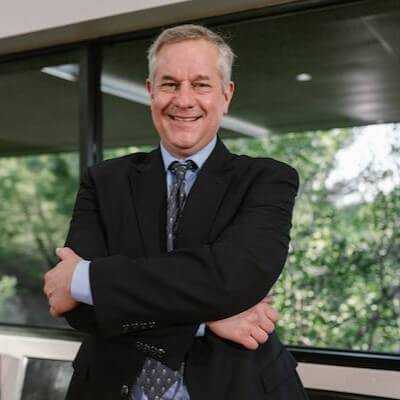

“The team at Prosperity Accountants are very experienced accounting and tax professionals. Client service and their proactive advice is the best I have ever experienced from an accounting firm.”

Dean Nicolaou

Our business solutions.

We help businesses reach their financial goals and pay less tax with the following solutions.

Business Start-up Advice

Starting a new business is scary. There’s heaps to get your head around – business structure, tax, funding, hiring, banking and invoicing, to name a few. We have helped hundreds of startups on all these areas.

Bookkeeping and Payroll

Having your accountant do your bookkeeping is more reliable, efficient and accurate. Unlike bookkeepers we look behind the numbers. We also provide up-to-date, real-time data helping you make informed business decisions using the latest cloud technologies

Accounting & Tax Compliance

We provide tax and accounting services that ensure your business meets ASIC and the ATO compliance obligations all year round. We offer fixed fee packages designed to scale with your business with year round unlimited support.

Business Strategy & Advice

We go beyond traditional tax compliance services. We add value to your business by providing strategies to improve sales, profits and increase cash flow. Discuss new investments or major hiring decisions with us.

Tax Advice & Structures

We provide proactive all year round tax planning advice so you never pay more tax than you should. We create innovative annual strategies to deal with every tax eventuality for your business and model their impact.

Asset Protection Advice

We provide advice on how to structure your personal and business assets to protect your hard earned assets. We set up Companies, Trusts, and Self-Managed Super Funds and provide ongoing advice.

Our business resources.

Check out our extensive library of content to help you with all things business.

The Essential Financial Management Toolkit: Mastering the Fundamentals for Small Business Success

Tax Planning Essentials for Small Businesses and Startups

The Art of Tax Planning: Strategies for Small Business Tax Efficiency and Savings

The Power of Automation: Streamlining Your Business Processes with Accounting and Financial Technology

Navigating the Australian Tax Landscape for Small Business Owners: Compliance, Deductions, and Tax Planning

Mastering Cash Flow Management for Small Businesses

Effective Tax Planning for Small Business Owners: Minimising Tax Liability and Maximising Profitability

Maximising Cash Flow in Your Business: Strategies for Improved Financial Health

Frequently Asked Questions.

We are expert small business tax accountants can help manage your company tax, partnership tax and trust tax returns, to cloud-based bookkeeping, advisory and compliance packages. We take the burden of accounting management

Absolutely, we offer a complimentary meeting so we can get to know each, see if we are the right fit and discuss services and fees.

We do not believe in hourly rates. We provide fixed fee, transparent monthly service packages through our Business Essentials Pack. We also have other services which we quote fixed fees. Go to our pricing page and request a quote.

We certainly can! We can help you with advice on how to get started, what business structure to use, set up your business structure, get you up and running with an accounting system and we can also help you with feasibility studies and finance applications

You can book a consultation by clicking on links on our website and you can also go to our pricing page and request a services and fee proposal.

Trusted by over 500 Australia-wide businesses for their tax & accounting needs.